Poor people spend. Wealthy people save.

I have been in corporate life for 5 years already, and I still don't have savings.

If you're feeling the same way too, no worries. It's a normal crisis to feel, especially in a third-world culture where we, as their children, are raised up as "investments" of our parents. That's why when we start to work we are obliged to give back and sustain the rest of the family's bills, groceries, utilities, and allowances. Not doing so means "abandoning the family."

It has its pros and cons definitely, especially in dealing with people and relatives, but one thing's for sure. We don't have savings. Or, let me rephrase: we can't save.

Too broke to save

When my $360 monthly paycheck comes, and I started listing out the needs, groceries, and bills (all for the family) and the monthly allowance of parents (and maybe for you, also the tuition of your siblings), most of the time only about $20-$25 remain. No room for new clothes, shoes, or gadgets, even installments will take me years to buy a $500 computer.

In these times, at least, I can treat myself to a good cup of coffee. If I saved the remaining amount, I will be too deprived of life and will lose the ability to want things (and will be continually envious of my batchmates in high school that flaunts cars and travel pics), because I am just barely getting by and just working for the bills to survive.

Maybe if I had more income, I could save more. Or let's say okay, I'll just shun all these and save the remaining amount and will not want anything material and live like a hermit. A $200 annual savings is not even enough for a 1-month emergency (and people say we should have 3-6 months of emergency savings for difficult and out-of-control times).

It seems so insignificant, so why save?

I started reading online, everyone encourages saving money and markets something called the 50-30-20 rule, and other strategies that are hard to comprehend with my income. To save 20% of income or more, to embrace frugality. They somehow package it that all money spent should be for "needs" only, and when I don't save at least 20% income I am not frugal enough.

I mean, how?? I never spend on expensive things, and all of my expenditures are for needs, and here they are, telling me I am not frugal enough? Ridiculous.

Do you feel the same way? I somehow feel alone in this. Let me know your story in the comments below.

The Lottery Myth

This is why, I observed, many people still buy lottery tickets despite being broke. Educated people think it's ridiculous that instead of saving that small extra money, they just waste it buying tickets to 0.000000003% chance of winning a million dollars.

But you can't blame them, if that is giving them hope that even how broke they are, they have an equal chance of getting a million money like other people who worked in high positions, came from privileged families, or running businesses with just a piece of a ticket.

No matter how long the wait and how many tickets they buy, they'll risk it, because when they see their current circumstance, it seems impossible to reach that million even if they work as hard for the rest of their lives. They'll gonna take that chance.

But the real lack is financial education and lack of patience. Institutions and companies don't teach about the value of money but encourage excessive consumerism as this is their business model.

No one teaches about saving, but the media every day shows the rich and luxurious lifestyle, and everyone should desire it. No one is talking about patience, everyone is capitalizing on FOMO so we need to get it now.

When talking about the stock market and investment, everyone is afraid they think it's a scam and always has the risk of losing money when in fact their day-to-day life is riskier (and losing more money) as well.

It's the whole way of how we view money is that was lacking. As Morgan Housel says in his wonderful book The Psychology of Money, "when it comes to money, we are all amateurs."

When it comes to money, we are all amateurs.

The Importance of Saving

I'm writing this to represent how I understood the importance of saving from the perspective of a financially broke person like me. Because of the pandemic, after 5 years in corporate life, I now find how important saving is and investing, and I am going to commit to it no matter how small my investment seeds are because something small is still better than nothing at all.

Something small is still better than nothing at all.

And if you're struggling with your finances as well, and you said that you are also too broke to save? We need a mindset shift.

In the following points, I'm going to show you how I managed to prioritize savings and investments with the little income that I have, and how it freed me up from the stress that I'm not saving enough with just a few but big mindset shifts.

1. Saving teaches us Financial Peace, not just freedom.

Everyone wants the path to financial freedom, where we can buy whatever we want, whenever we want. This is the mindset that big consumer companies want us to have. It capitalizes on our ability to want things, and they make more money. Hence, financial freedom is the way to go, right?

The reality is, most people aim not for financial freedom, but a financially-free lifestyle. And because of excessive consumerism and FOMO, people are willing to go into debt for the next 5 years just to buy the latest iPhone, accepting that they are now a slave to their creditor until the last penny is paid (with interest).

Then after finishing the payment, a more sophisticated gadget now arrived, leaving the people miserable about what they have paid for the last 5 years. Tech companies had us in the palm of their hands. Is this really freedom?

But the fact is, true happiness and financial freedom are not being able to buy what we want whenever we want, because most things that we want are not beneficial.

What we want is the ability to sleep every night not worrying about any creditors that might knock on your door and take your valuables as collaterals, or the ability to not think about how to pay for the things we can't afford, or the feeling of assurance when we wake up in the morning that we don't owe anyone. This is financial peace.

It is better to suffer financially without debt rather than being comfortable now but full of debt and creditors' anger later. This is what we want, and will truly make us feel contented. A life where all debt is paid, and we buy whatever we need, not worrying that we owe someone anything. Contentment is the first step.

Strive for a life of financial peace, not just freedom.

2. Saving nudges us to always pay in cash.

Debt is not an option. If we need to borrow money from a credit card or a relative to purchase something, it just means that we can't afford it. If we really want it, save up for it.

Credit cards are made for convenience and emergencies only when we're not able to withdraw cash and we need to pay for the restaurant or an emergency e-payment for bills that need to be paid on time when our salary is delayed.

This is the hardest mindset shift to apply actually, but once we get the habit of thinking that, "I can't afford it" to "I'll save up for it", it will train your mind to be contented and be creative with the little of what we have, and encourage you to save even when broke, which is what this article is all about.

Note: There are exceptions for this, like computers, guitars, and gadgets that will be used for side hustles and side businesses, we can use credit cards for this because what we're buying is a tool that will make more money for us. In these cases, our goal is to let these items pay for themselves, by using the profit made from the side hustle where the computer or gadget is being used to pay for the premiums instead of your salary.

If you really want it, save up for it.

3. Saving guides us to spend less – by desiring quality more.

This is the most famous wording of most financial gurus out there, spend less.

It's like being a monk. Desire less, so you can spend less, hence more savings. So, most people interpreted this to resort to cheapskate items in rock-bottom sales and end up settling for a bunch of junk and useless items.

But for us in the third world, even if we spend less, the needs are far greater than our means. So how do we do it? By desiring quality more.

Back then, I always have a little bit of everything, at rock-bottom cheap prices. A little $5 cable here, a little cute $2 phone stand there, a $4 headset, a $10 cheap shoes. Little did I know I have 6 useless cables already and broken phone stands, with broken soles in my shoes and a broken left ear channel of my headset in a span of three months.

Then I go, "oh well, it's cheap anyway, I'll just buy again", not realizing that I bought the same item 4 times in a year because it keeps getting broken. Hence, for the shoes, I already spent $40 on 4 different shoes that gave up on me every 3 months. This is compounding spending!

All these have changed when I bought my first $60 original Nike shoes in a 50% factory sale. Instantly, at first, I go, "am I worthy to have this?" but as soon as I wore it, I was so happy and accomplished, and my self-esteem is boosted.

The better part? It was a perfectly fine pair for the next 2-3 years. Imagine, 2-3 years of not thinking about my shoe getting broken or thinking about buying the next shoe. Just one functioning comfortable high-quality pair of shoes that I'm sure will not give up on me anytime. The amount of peace of mind it gave me.

Then I bought an original $55 Jansport bag. After 4 cheap bags that kept giving up on me every 6 months, this bag is still with me now after 5 years, alive and well. The peace of mind that I don't need to buy a bag for the last 5 years is so satisfying.

You see, with the little amount of $20 savings sustained and untouched for 3-4 months, I can afford to buy items that will last me 5 years. In a 5-year time horizon, I have spent less on bags, because I desired quality more.

And a little trick: since this is expensive when you bought it, our natural tendency is to take good care of it. So it cultivates a strong sense of stewardship with what we bought and handling it with so much care, which we don't do in cheap items! Win-win!

In a 5-year time horizon, I have spent less on bags, because I desired quality more.

So dear reader, don't be afraid to desire high-quality items. It may look expensive now, but the peace of mind that it will give you for the next years and the character development in the area of stewardship are irreplaceable.

Now that we have already cleared up our mindsets and set up our spending habits in the right direction, let's talk about how to start and where to actually park your money and begin the path to financial peace.

1. Start saving $1 per paycheck, then increase by $1 to succeeding paychecks.

I believe this is the best way to start the habit of saving. A $1 with +1 increments is not intimidating, right? Remember that the first step is not the amount, but the habit of setting aside wealth. This slow increment is a manual and beginner's version of compounding.

A common adage in the internet says "Compounding is the 8th wonder of the world." A small and gradual increase sustained and uninterrupted for a long time makes compounding go wild.

If we use this formula, imagine we have a bi-annual paycheck, meaning for the first month we have $1 (about 50 PHP) saved for the 15th, then $1+$1 on the 30th. That means we saved $3 on the first month already! (you might think, oh yeah, it's $3, yey?) but hold on a little bit. Let's finish the whole year.

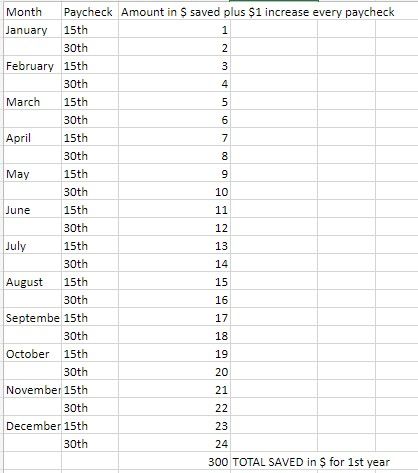

If we keep adding $1 to succeeding paychecks, here's what will happen (gonna flex my wonderful excel skills):

Suddenly we can afford a high-quality shoe, a bag, and a phone in our first year of work! We are not broke anymore, we are worth $300 now! Fun though, some of our colleagues who have higher pay than us might not even have $300 worth of savings by the end of December due to their spending, so way to go if you do this!

If we decided to repeat the process, it's okay! Every year we save $300, and after just 3-4 years, we will have a thousand dollars and more. Suddenly, we can now afford to not worry if we suddenly lose our job, or we can now buy that coveted computer that will help us start our business and let that gadget work for us for the next 5 years.

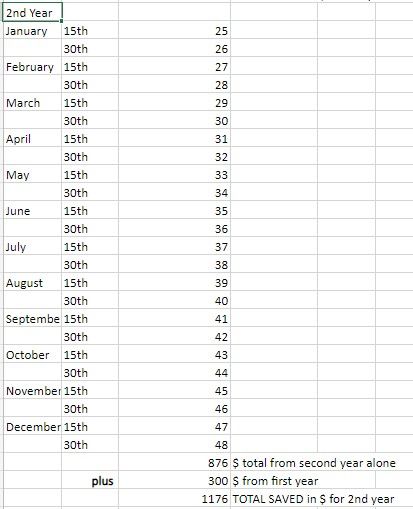

Now, what if you got promoted, or you get excited with the results and ended up wanting to save more and continue adding just $1 more after the $24 mark, now compounding is going to be wild. Are you ready? Take a look:

A thousand dollars in two years of work! Just by sheer discipline and mindset shifting and a huge deal of determination and patience, it is possible from a $1 increase sustained uninterrupted for a long time. And two years isn't even a long time! (Remember how fast the last two years have gone by?) Now, imagine increasing by $1 until the 5th year, or 10th year, you do the math.

This is certainly not easy, in fact, it is really, really hard. Life gets in the way most of the time. But this is the surest way to build wealth: slowly and consistently.

Our life is never easy when broke (A), and staying broke while not doing anything about it is even harder to take in (B), so why not choose the hard things anyway that will give us phenomenal returns through sheer saving (C)? Options A, B, and C are all hard lives anyway, but option C at least will give us a great reward.

Sadly, people without this knowledge still choose the hard life of being broke and the hard life of staying broke, I hope you and I choose the hard life of saving.

We can keep this saved money on our current bank savings account or the payroll account, anywhere as long as it isn't in cash inside piggy banks (as these lose value over time due to inflation of prices). But a better way to park your money is in a place where money is productive.

2. Place your savings in a high-interest savings account.

I have recently discovered the world of digital banks through a friend, and with these digital banks, they don't have to maintain balance, and they place a +2.5% interest income on the money you placed in your account every month to help your money grow further!

Right now, my savings are placed in ING Save digital bank. (I'm not sponsored, this is a personal choice of mine, and think of it as my genuine recommendation for you as a friend.) It is being regulated by the local government with insurance here in PH so my money is very safe with them. And they don't even have a minimum deposit or maintaining balance.

Local banks take away money through maintaining balances and penalties, these digital banks like ING give us money instead. You can google about high-interest savings accounts in your specific country for your safety, but if you are in the Philippines, ING Save is the way to go.

This means that we can do everything from Step 1 and park our money on ING save, and even if we place 1$, we are free from the worry of deduction of below-maintaining balances. We can start our saving journey to financial peace from $1 and safely place it there, and enjoy an additional 2.5% interest on top of our savings annually!

So, just a quick estimate and overview only (for financial nerds, yes this will not be accurate, this is just for appreciation only for beginners, most people reading this might be their first time reading this, so please bear with us beginners), from our 1st year of saving above, we have $300 by December. If we parked it in ING Save from the beginning, by December, we will have a total additional 2.5% annual income on top of $300 dollars, which (in simple math, for appreciation purposes) could reach about $307.50! That's a $7.5 freebie, greater than our 1$ beginning money! Our money worked for us, not us working for them!

This is just a rough estimate, but the example above is a brief introduction to compounding interest. A consistent $1 increase per paycheck plus a 2.5% interest annually will compound like crazy if sustained and uninterrupted for a long time. (I will make a detailed separate post about this to satisfy financial nerds so make sure to subscribe to my mailing list to be updated straight in your mailbox!)

Imagine compound interest at work if we continue the 2nd year scenario stated above, and added +2.5% at the end. $876 + 2.5% = $897.90, plus the $307.50 we earned in the first year, for a total of $1205.40 already! A $29.4 freebie income already (that's greater already from your 1st year December contribution of $24) just by letting compound interest work sustained and uninterrupted for two years!

Imagine that at work for 5 years, or ten. And we're only talking about saving $1 at a time! We still haven't ventured about investing in the stock market, which on average, can reach around 11% annual returns!

I'm sorry I got carried away. But, I hope this gives some hope for you and me financially even right now when we are still broke. Just last week I had to withdraw my entire ING savings for an emergency, just to survive to the next paycheck.

So I will start from $1 again this coming paycheck and place it on ING Save, and this time, I am committed, to be disciplined and save consistently $1 at a time, sustained and uninterrupted from now on.

Maybe, at least, even when I am late in the game, I could still say that I've saved a thousand dollars before I enter my 30s.

Savings as your Net Worth

When Forbes magazine updates their Top 100 Richest People in the World annually, it's interesting that they count their "richness" by their net worth, not their spending. And true enough, their richness is measured by the size of their investment and assets, not their spending.

Of course, definitely they have financial freedom, they can buy whatever they want, whenever they want, but I don't think all of them have financial peace. Imagine, every night, them, having fear of losing everything in a single war event or a global crisis like a pandemic, or an inside collapse due to corporate fraud or politics. Someone working with them talking behind their backs, and all kinds of conspiracies and betrayals we see in movies and series because that really happens in real life.

Is that the life we want? I believe I don't, I am contented with enough.

True wealth is not measured by how much we spend, but by how much we save.

Compared to these billionaires, right now, my net worth is nothing. But what could encourage me to save, even it seems so futile and insignificant? By thinking that my savings are my net worth.

True wealth is not measured by how much we spend, but by how much we save. And it's exciting to know that you and I can grow our humble net worth, one dollar at a time, sustained and uninterrupted for a long time.

And maybe, one day, we can break away from being broke, and achieve financial peace.